net investment income tax brackets 2021

A the undistributed net investment income or B the excess if any of. 10 12 22 24 32 35 and 37.

Summary Of The Latest Federal Income Tax Data Tax Foundation

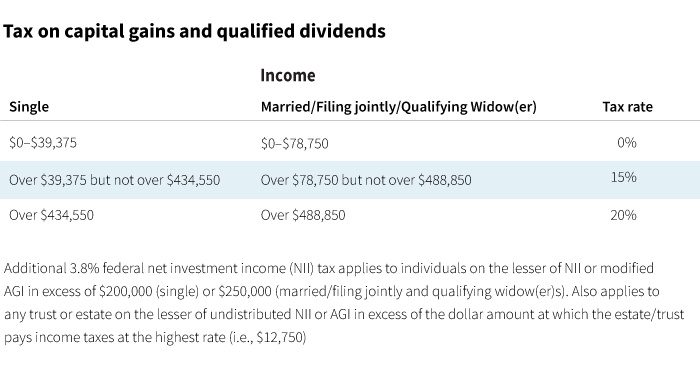

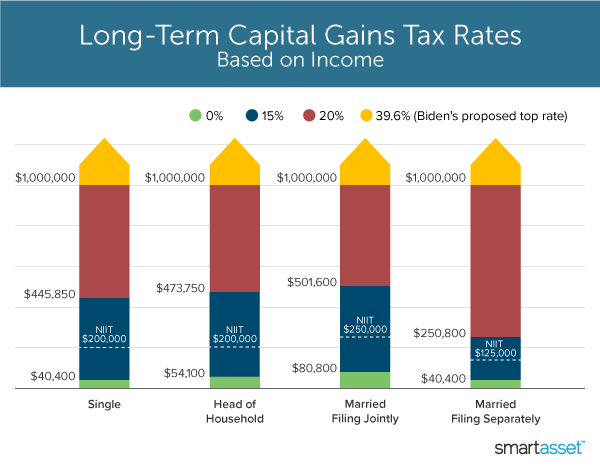

If you are single and make a 45000 capital gain on top of your 40000 in ordinary income your long-term capital gains tax.

. Income phaseout is 125000. For 2021 the tax bracket thresholds were increased by approximately 1 over 2020 levels. If youve held an asset or investment for one year or less before you sell it for a gain thats considered a short-term capital gain.

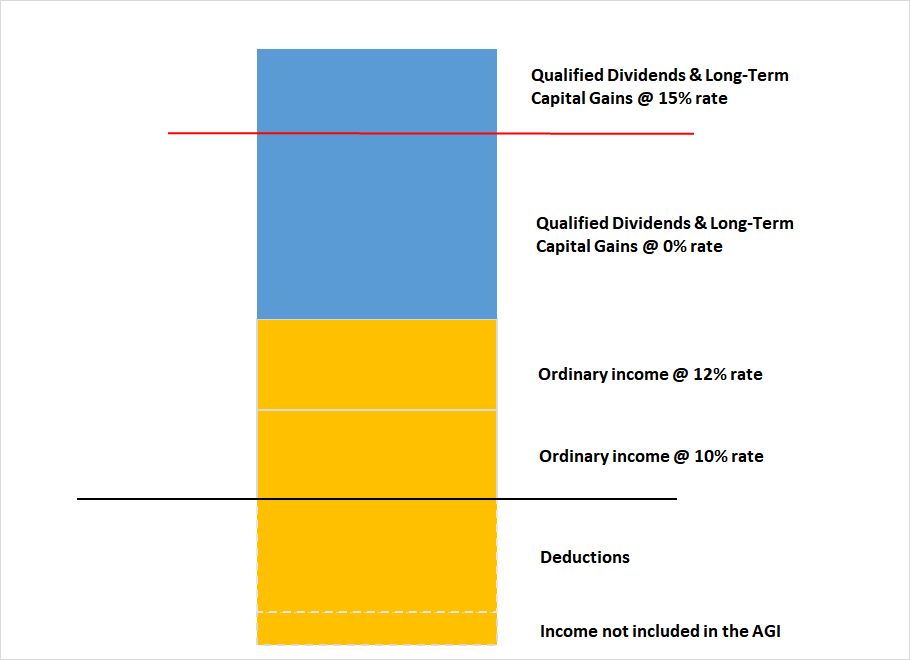

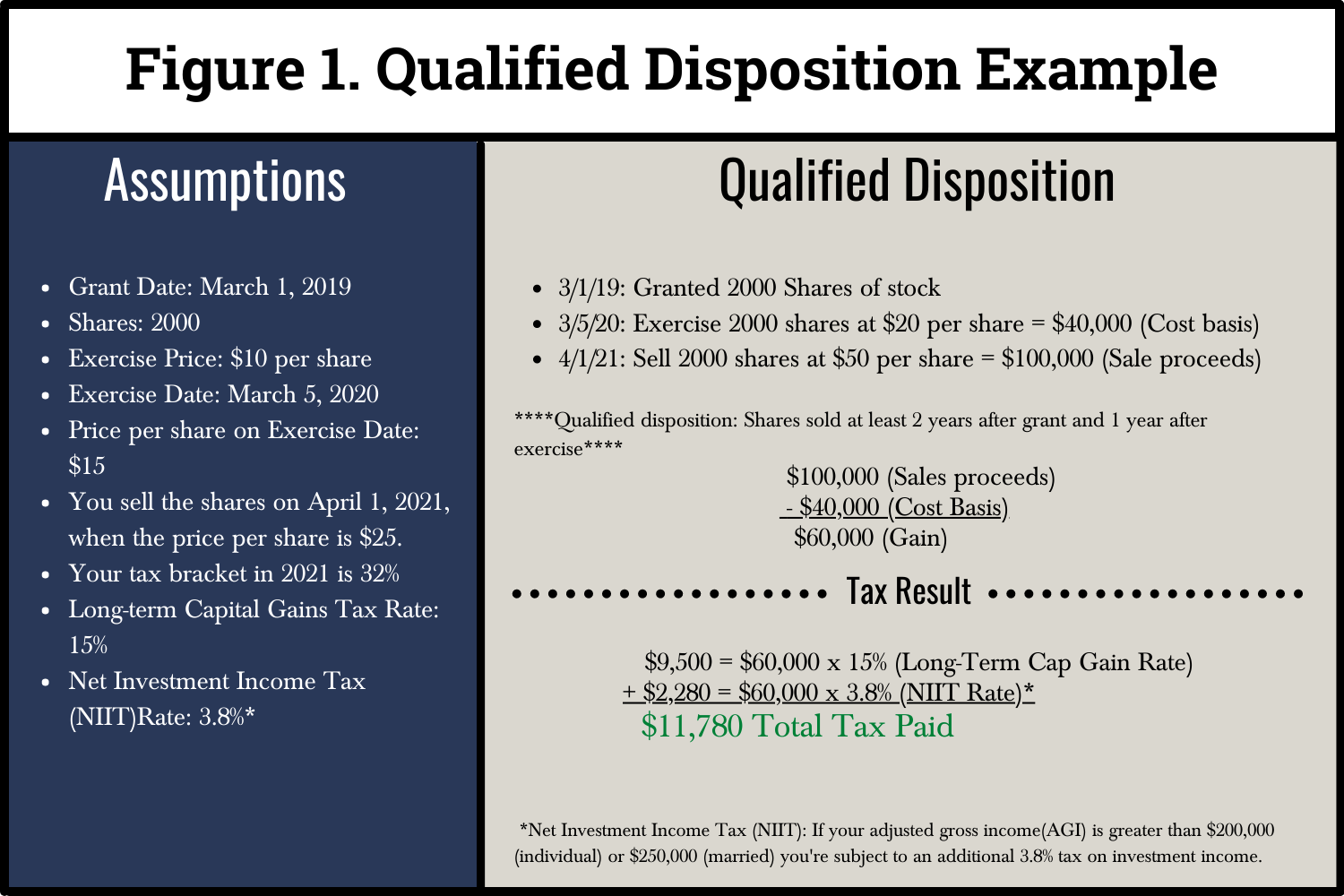

Each year the IRS adjusts the tax brackets for inflation. The adjusted gross income over the dollar amount at which the highest tax bracket begins for an. Net Investment Income Tax NIIT is a 38 same tax rate tax year 2021 2020 of Medicare tax that applies to investment income and to regular income over a certain threshold.

The tax rates and brackets for 2021 and 2022 are provided in the following two charts. For 2021 Roth IRA contribution limits are unchanged at 6000. Unearned income Medicare contribution tax Net investment income tax 2021 2022.

In the US short-term capital gains are taxed. Workers age 50 and older have an additional 1000 catch-up contribution limit. Form 8960 opens in new tab to calculate the surtax.

Your tax bracket is determined by your filing. Weve summarized income tax rates and details below for you for the tax year 2021 and filings in 2022. You are charged 38 of the lesser of net investment income or the amount by which the MAGI exceeds the income thresholds you must pass to incur NIITs.

The net investment income tax is a 38 tax on investment income that typically applies only to high-income taxpayers. Overview Data and Policy Options Since 2013 certain higher-income individuals have been subject to a 38 unearned income. April 28 2021 The 38 Net Investment Income Tax.

The 2022 Income Tax Brackets. You can see this in the tax brackets section above. For the 2022 tax year there are seven federal tax brackets.

What Are the Capital Gains Tax Rates for 2022 vs. To clarify the 2021 tax. Surtax on Net Investment Income.

A Married Filing Jointly household has 300000 in income from self-employment and. Stay in a low tax bracket. No earned income credit is allowed if the aggregate amount.

Most investment income is taxable but there are a few strategies for avoiding or at least minimizing the taxes you pay on investment returns. The investment income above the 250000 NIIT threshold is taxed at 38. 1 It applies to individuals families estates and trusts.

What Is The 3 8 Net Investment Income Tax Niit Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

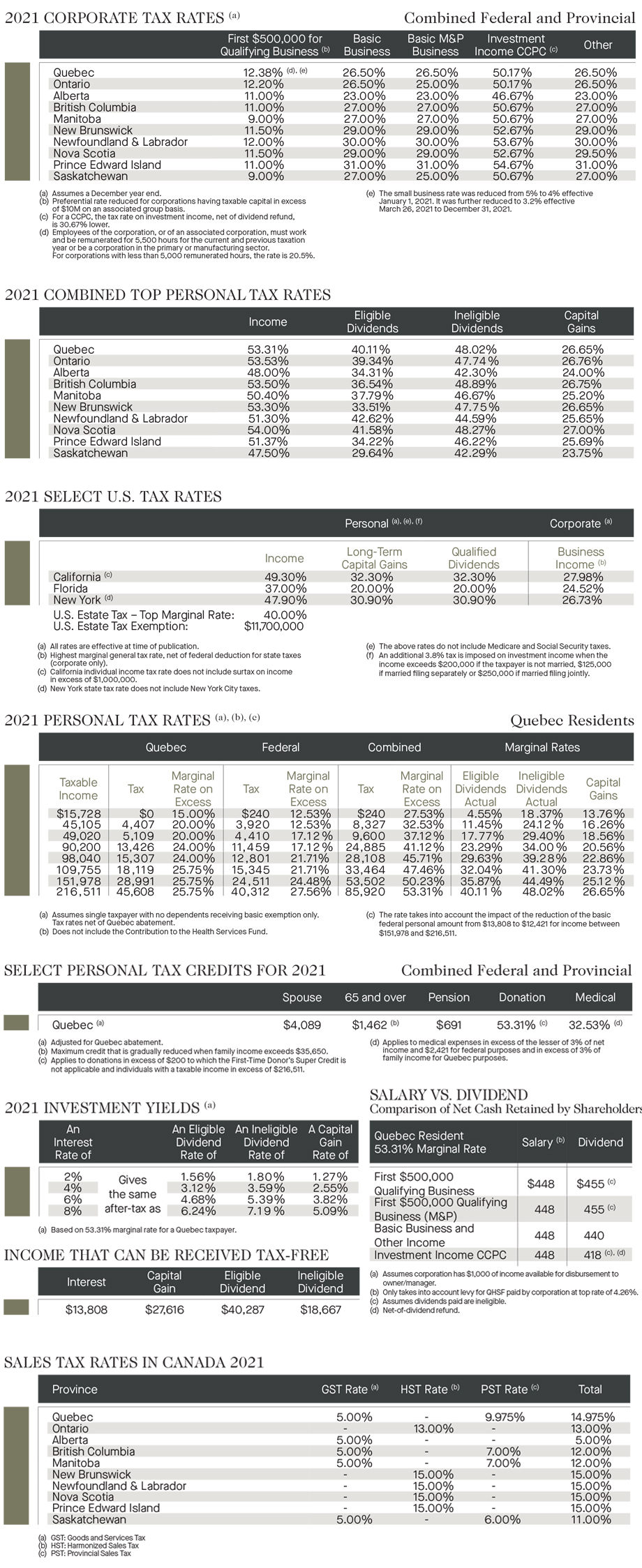

2021 Quebec Tax Rate Card Richter

Understanding The New Kiddie Tax Journal Of Accountancy

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Gauge Your Tax Bracket To Drive Tax Planning At Year End Putnam Investments

Evaluate Your Iso Strategy To Create Value And Save Taxes

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

A Guide To The Net Investment Income Tax Niit Smartasset

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

What Is The The Net Investment Income Tax Niit Forbes Advisor

What S In Biden S Capital Gains Tax Plan Smartasset

Short Term And Long Term Capital Gains Tax Rates By Income

Understanding The Net Investment Income Tax Fmp Wealth Advisers

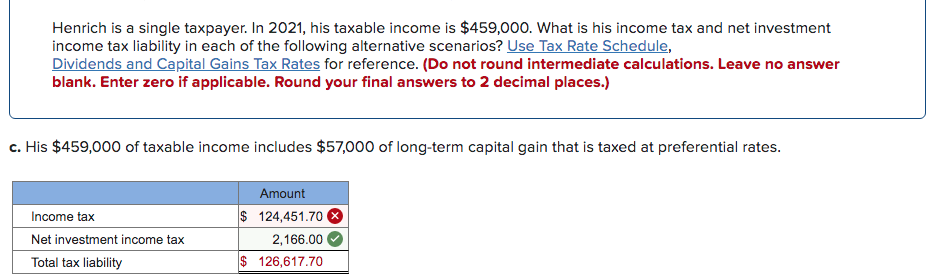

Solved Henrich Is A Single Taxpayer In 2021 His Taxable Chegg Com

2021 Tax Brackets And Deadlines To Know Quick Reference Guide

:max_bytes(150000):strip_icc()/GettyImages-1160172463-9d00a407bf63428a9bb030b683d1c863.jpg)

What Is The Net Investment Income Tax

Income Tax And Capital Gains Rates 2020 Skloff Financial Group

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What S The Difference

Net Investment Income Tax When Does It Apply Calculating The Impact And How To Avoid Youtube